New Delhi : The finance industry is undergoing a notable transformation, moving beyond the traditional focus on purely financial gains. This shift is being driven by Social Stock Exchanges (SSEs), which emphasize investing in social and environmental causes alongside the pursuit of monetary returns. SSEs are redefining the way investors think about value, introducing a more holistic approach that considers both financial and societal impact.

SSEs: Aligning Capital with Social Impact for a Sustainable Future

As the world grapples with critical challenges like climate change, poverty, social injustice, and inequality, SSEs provide a unique platform for investors to contribute to meaningful societal progress while meeting their financial goals. By aligning capital with causes that address pressing global issues, SSEs are paving the way for a more responsible and sustainable investment landscape.

What is Social Stock Exchange (SSE)

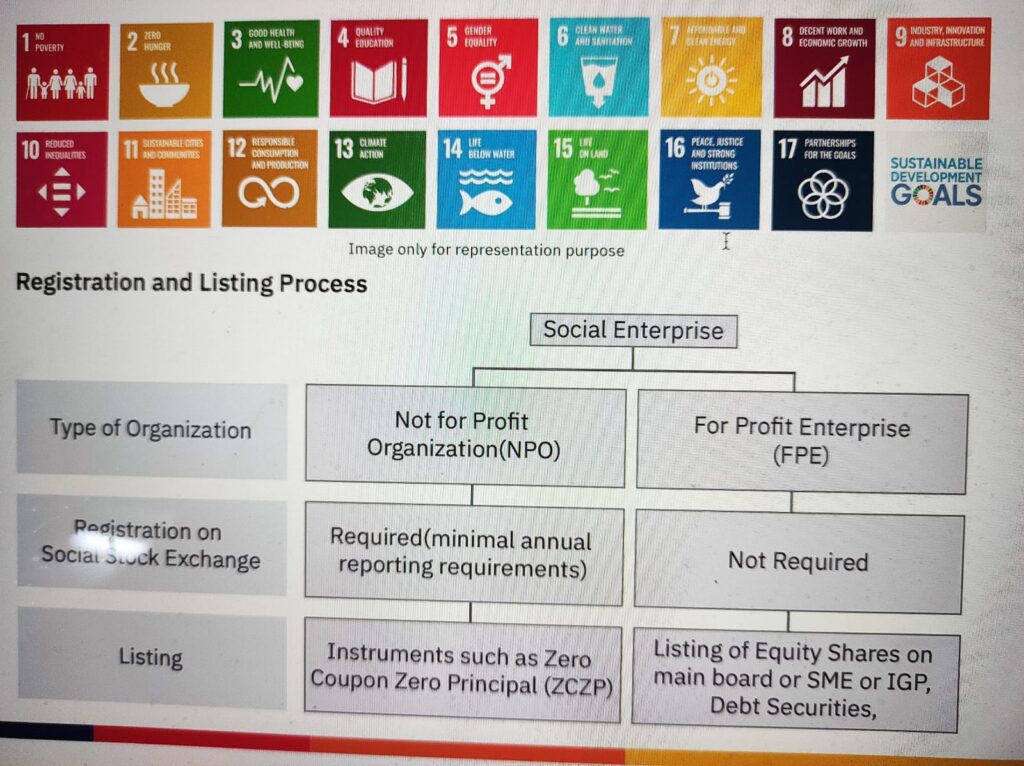

The Social Stock Exchange (SSE) segment on the NSE offers Social Enterprises, including Non-Profit Organizations (NPOs) and For-Profit Enterprises (FPEs), a distinct opportunity to register and raise funds through a recognized exchange platform. This initiative enables socially driven organizations engaged in eligible activities to access capital in a regulated market, enhancing their ability to fund and expand their impact on societal and environmental challenges.

Key Benefits of Social Stock Exchange

- Enhanced Market Access : The Social Stock Exchange (SSE) creates a structured platform that connects Social Enterprises with investors and donors, incorporating regulations that ensure financial integrity and accountability.

- Alignment of Social Goals : With the flexible investment options available on the SSE, there is a broader range of choices for both investors and investees. This fosters seamless connections between parties that share similar missions and visions.

- Performance-Driven Philanthropy : The performance of listed enterprises on the SSE will be monitored, promoting a culture of philanthropy focused on social returns.

- Lower Registration Costs : The SSE minimizes costs for both issuers and investors/donors by charging nominal fees for registration and listing.

- Alternative Funding Source for Social Enterprises : While central and state governments play a significant role in achieving sustainable development goals, the SSE offers an alternative funding avenue that encourages both new and established social enterprises.

Zero Coupon Zero Principal Instrument (ZCZP) – Key Features

- Dematerialized Issuance : ZCZP instruments are issued exclusively in dematerialized form.

- Issuance Modes : They can be issued through a public offering or via private placement.

- Minimum Issue Size : The minimum size for issuance is set at ₹50 lakh.

- Minimum Application Size : The minimum application amount is ₹10,000.

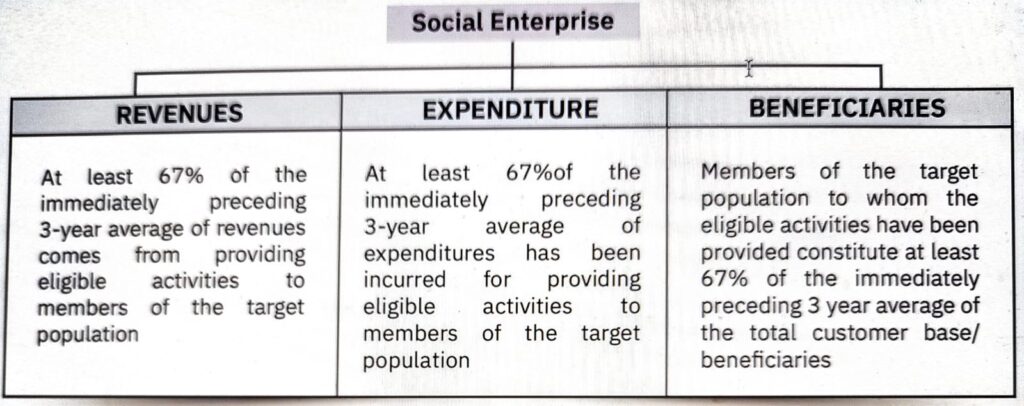

Eligibility Condition for being identified as Social Enterprise

1) Predominance (Any one of the following)

2) Target Segment

Social Enterprise shall target underserved or less privileged population segments or regions recording lower performance in the development priorities of central or state governments.

3) List of eligible activities for demonstrating primacy of Social Impact

The Social Stock Exchange (SSE) represents a groundbreaking method for financing social and environmental initiatives. By providing a structured platform for both Non-Profit Organizations (NPOs) and For-Profit Enterprises (FPEs), the SSE enhances capital access while ensuring accountability and transparency. This innovative model fosters collaboration and encourages performance-driven philanthropy. As SSEs evolve, they can significantly impact sustainable development goals, ultimately redefining value in finance and promoting a more responsible, inclusive economy.

(Disclaimer: The source of information is the National Stock Exchange (NSE).)